金蝶KIS专业版资产负债表之往来科目重分类详细讲解

[全站通告] 想快速节省您的时间并可接受付费的朋友,可扫右边二维码加博主微信-非诚勿扰!

以新会计准则为例:

应收账款期末余额:

=ACCT("1122","JY","",0,0,0,"")+ACCT("2203","JY","",0,0,0,"")-ACCT("1231","Y","",0,0,0,"")

预收账款期末余额:

=ACCT("2203","DY","",0,0,0,"")+ACCT("1122","DY","",0,0,0,"")

一、问题描述

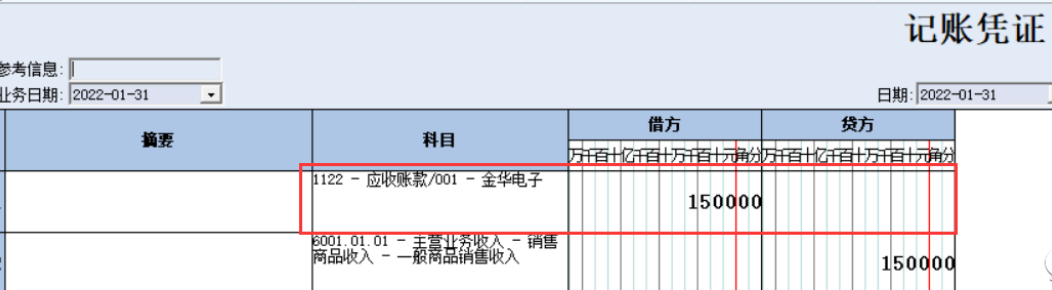

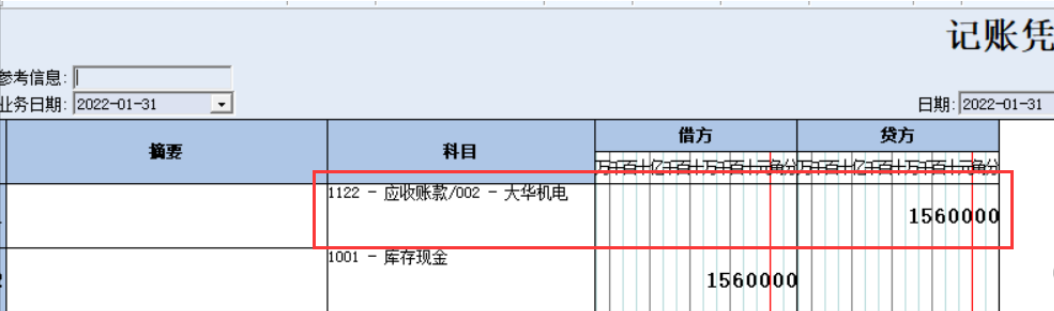

实际财务处理过程中,财务录入两个凭证如下图所示:

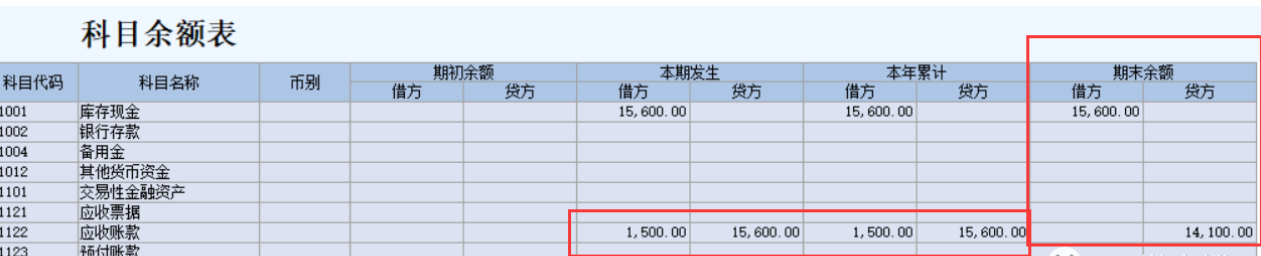

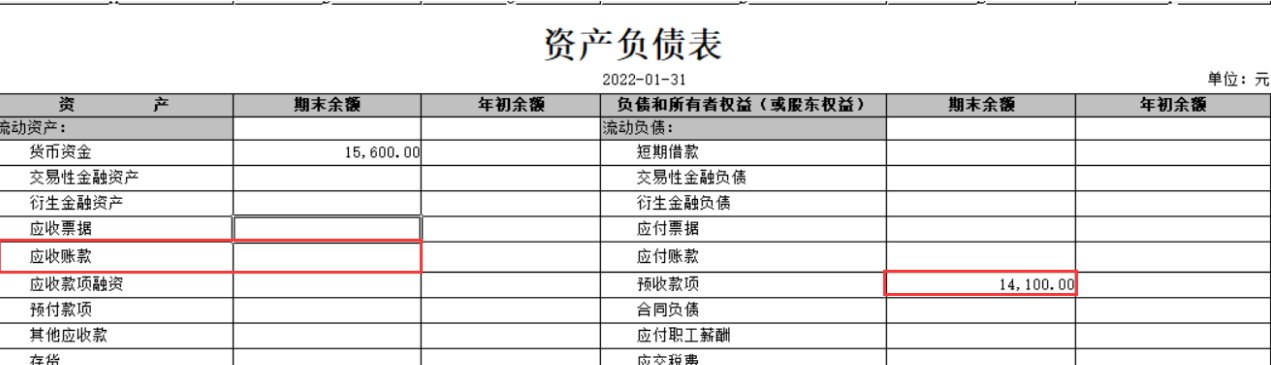

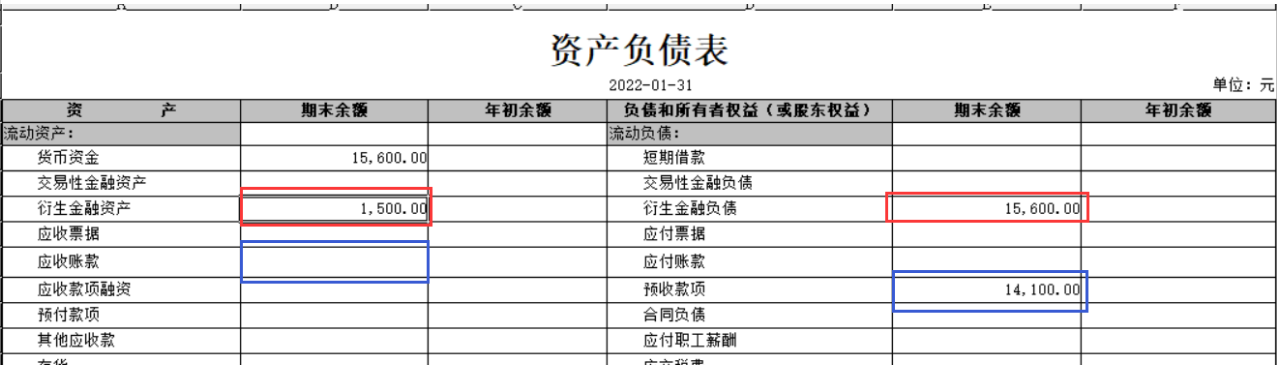

当我们根据系统预设的资产负债表公式进行取数时发现:应收账款期末余额为0,预收账款为14100,如图所示:

那么问题来了,明明实际数据中应收账款是1500,预收账款是15600,而且财务也实打实收到了15600现金,这样子出来的资产负债表数据就很难交差了。

其原因在于当资产负债表只是简单指定了一级科目的DY(贷方余额)和JY(借方余额),那么软件就只会根据期末余额在“借方”或者“贷方”的处理逻辑来进行重分类。那么我们该怎么办呢?

二、解决方法

修改公式,以核算项目类别为重分类的依据,参考这个公式修改:

=ACCT("1122|客户|001:002","JY","",0,0,0,"")

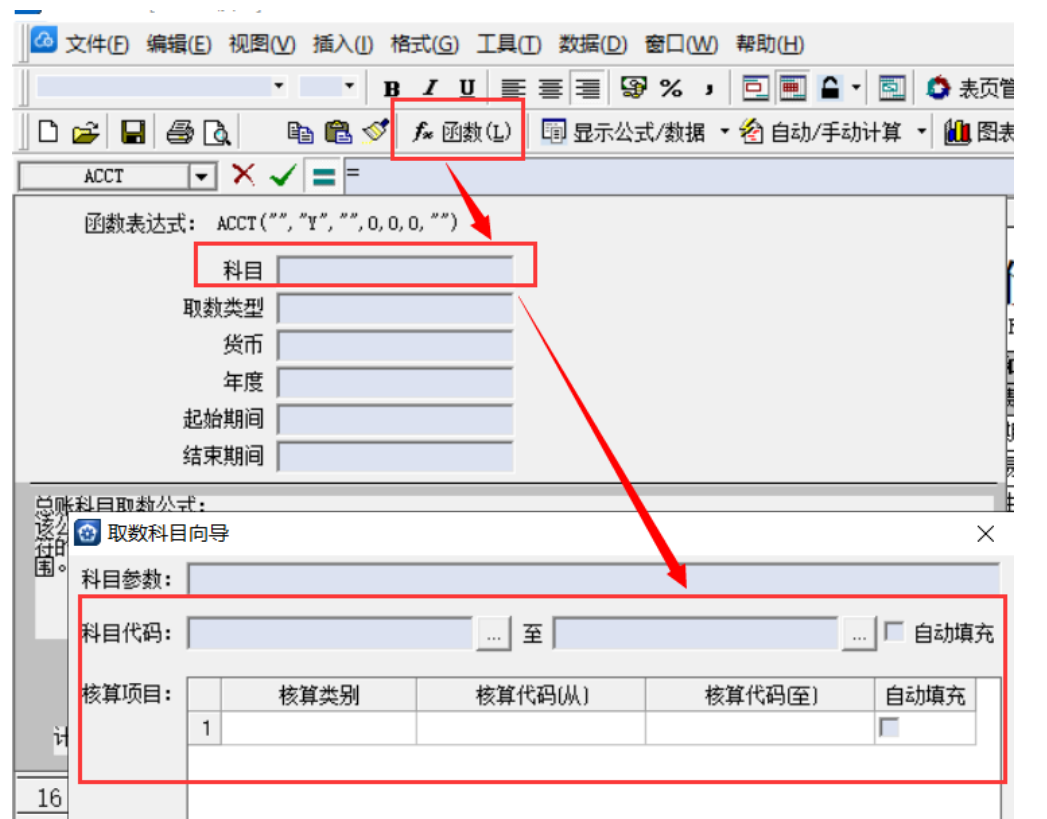

,客户是核算类别,001和002是客户代码,可以根据实际情况修改,具体操作如下,在公式模式下点击函数,选择ACCT以后“科目”按F7出来选择【科目】和【核算项目】信息,取数类型根据需要设置成JY或者DY

为了方便对比,我在衍生金融资产期末余额中输入:

=ACCT("1122|客户|001:002","JY","",0,0,0,"")

,衍生金融负债期末余额中输入:

=ACCT("1122|客户|001:002","DY","",0,0,0,"")

,最终得到的资产负债表数据如下图所示:

通过这样对公式修改以后,我们不难发现,新得出的数据:应收款1500,预收15600,更符合实际业务。这样一来也就保证了往来科目数据跟实际业务的一致性。

附上新会计准则科目核算项目类别重分类修改后的公式:

应收期末:=ACCT("1122|客户|","JY","",0,0,0,"")+ACCT("2203|客户|","JY","",0,0,0,"")-ACCT("1231","Y","",0,0,0,"")

应收年初:=ACCT("1122|客户|","JC","",0,1,1,"")+ACCT("2203|客户|","JC","",0,1,1,"")-ACCT("1231","C","",0,1,1,"")

预付期末:=ACCT("1123|供应商|","JY","",0,0,0,"")+ACCT("2202|供应商|","JY","",0,0,0,"")

预付年初:=ACCT("1123|供应商|","JC","",0,1,1,"")+ACCT("2202|供应商|","JC","",0,1,1,"")

应付期末:=ACCT("1122|客户|","DY","",0,0,0,"")+ACCT("2203|客户|","DY","",0,0,0,"")

应付年初:=ACCT("1122|客户|","DC","",0,1,1,"")+ACCT("2203|客户|","DC","",0,1,1,"")

预收期末:=ACCT("1122|客户|","DY","",0,0,0,"")+ACCT("2203|客户|","DY","",0,0,0,"")

预收年初:=ACCT("1122|客户|","DC","",0,1,1,"")+ACCT("2203|客户|","DC","",0,1,1,"")